The Philippine automotive market could hit 500,000 units.

This was the bold projection made by the Chamber of Automotive Manufacturers of the Philippines (CAMPI) after 2023 witnessed a very strong comeback in sales. Total vehicle sales last year reached 432,936 units, combining data from CAMPI and the Association of Vehicle Importers and Distributors (AVID).

This represents a year-on-year growth of 20% and puts it 5% ahead of pre-COVID sales in 2019. As well, this number already includes sales of some of the new brands to the Philippine market, particularly the Chinese makes. It was a remarkable year for the industry.

As 2024 opened, the market powered on. Reported sales in January and February this year were estimated to outstrip year-ago levels by 17%. Despite the strong industry performance, however, CAMPI tempered its forecast to 468,000 units, a growth of 9% versus 2023.

With the inclusion of AVID sales, the market could possibly break its record sales of 473,000 units reported back in 2017. CAMPI president Atty. Rommel Gutierrez made it clear though that a 500,000-unit market is not entirely being ruled out.

The question that begs answering is this: What is driving sales of motor vehicles? Clearly, the revitalization of economic activity post-COVID is a key enabler. Last year, the country reported a GDP growth of 5.6%, and is projecting higher than 6% this year.

Inflation is starting to level off with an encouraging 2.8% rate in January, though rising slightly to 3.4% in February. Consequently, interest rates are not rising further, although they are expected to remain at the current elevated levels of about 6.5%.

Unemployment numbers are also dropping, reaching a 15-year low in the last quarter of 2023. And, of course, Overseas Filipino Worker (OFW) remittances continue to increase steadily at 3% to 3.5%.

All in all, the economy offers a very positive backdrop for the sustained growth of the auto market in 2024.

Another significant driver of growth is that motorization is seemingly picking up where it left off. From 2012 to 2017—when the market peaked—the automotive market was growing at double-digit rates averaging 20%. A correction happened in 2018 and 2019 after a surge in sales from pull-forward demand in 2017, due to a prospective increase in excise taxes on vehicles.

In 2020, COVID-19, of course, disrupted sales, dropping 41% from the year before. It has since reversed the drop, growing 16% and 24% in 2021 and 2022, respectively. In 2023, the market finally broke pre-COVID levels with sales of just under 433,000 units, or a growth of 20%. This is 6% higher than sales in 2019.

In 2023, nominal per capita GDP in the Philippines was reported at $3,900, and is projected to exceed $4,000 in 2024. By 2025 or 2026, per capita GDP is forecasted to breach $4,400, moving the Philippines into the “upper middle income” economic classification.

Given that 70% of our country’s GDP is accounted for by consumer expenditures, the rise in income levels will surely contribute to increased spending on durables as much as consumables.

A third driver of growth would be the flood of new car brands into the market. If there is one thing that attracts automakers like bees to honey, it is the sweet smell of expanding sales volumes.

A recent count shows at least 22 Chinese auto brands entering the Philippines. Arguably, it can be said that Chinese makers need to export their excess production capacities, thus their aggressive inroads into the country. On the other hand, they chose to focus on the Philippines rather than, say, Vietnam or other ASEAN markets—meaning they see a clear potential for our market.

New entrants have livened consumer interest in cars. It evidences the classic principle in economics—that supply creates its own demand.

More new models at different price points intended for different market segments or for newly emerging ones attract new buyers who otherwise would remain latent intenders. With the increased number of players, too, comes more competition among automakers. This could lead to more sales promotions and deals that would also entice more buyers to showrooms.

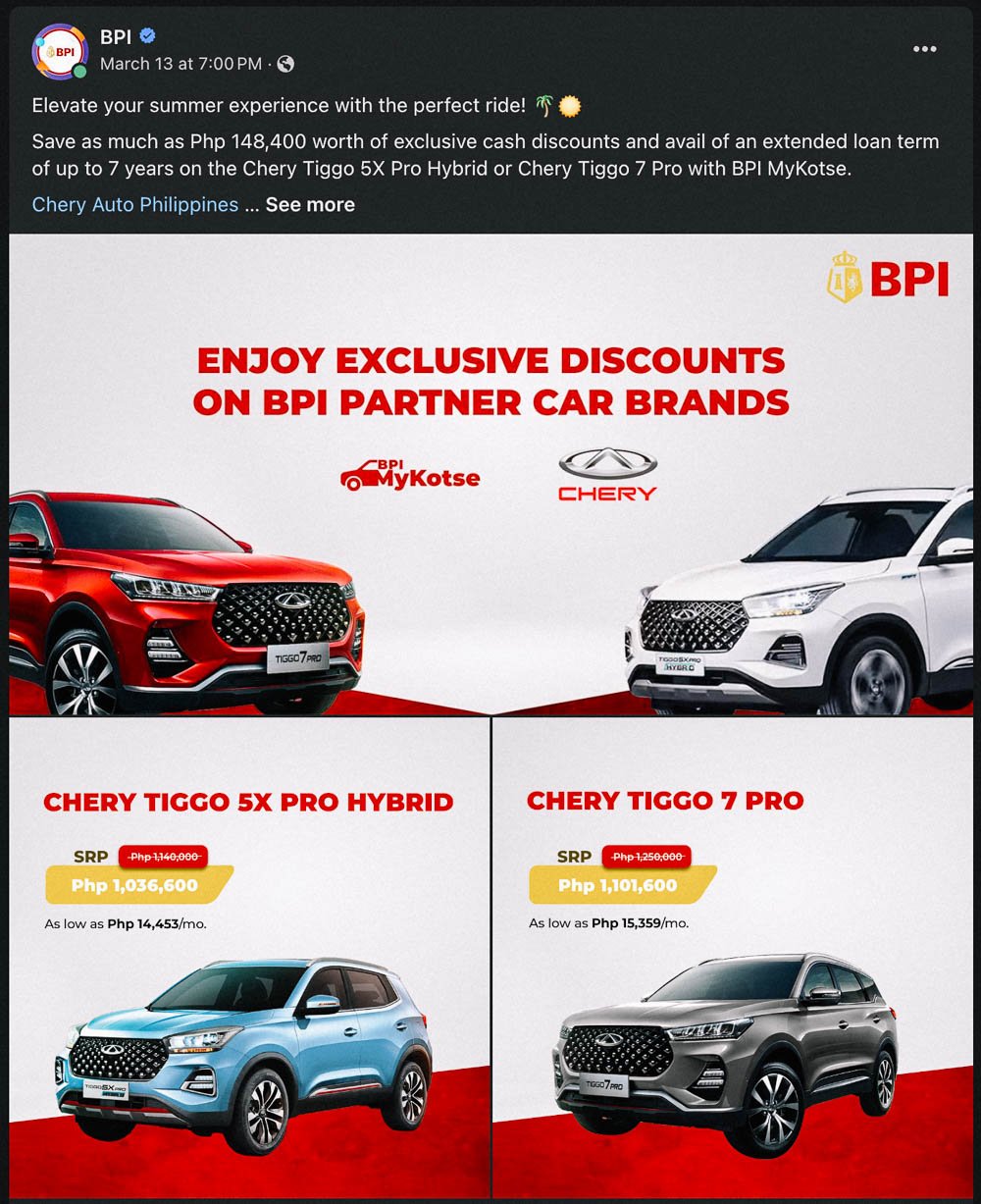

Yet another driver of auto sales growth is the return of banks and financial institutions to the market. All the key players—Banco de Oro, PSBank, Bank of the Philippine Islands, EastWest Bank—are back in force. Toyota Financial Service Philippines was practically the sole player during the COVID years.

Financing offers ranging from low down payment, no down payment, low monthly payment, deferred monthly payment, and low interest proliferate in the market. Access to consumer loans is an essential enabler to car ownership.

There are also emerging drivers of growth. Among others, these include the expansion of infrastructure, the return of full mobility, and the regional dispersion of economic growth.

Also, the growing calls for carbon-neutral mobility and the efforts of the government to promote the adoption of electric vehicles—hybrid, battery, plug-in, hydrogen, or fuel cell—may well result in a re-fleeting of vehicles currently in operation.

Undoubtedly, the complexion of the industry has shifted from a seller’s to a buyer’s market. Supply chains have normalized, and pent-up demand has already been digested. But the prospects for sustained growth in car sales remain very exciting indeed.

Comments