Globalization is about integrating people, economies and governments. It has been around for centuries—going back to the silk trade between Europe and China—and permeates almost every aspect of life and business. From 1948 to 2007, just prior to the Lehman Financial Crisis of 2008, world trade increased from $59 billion to almost $14 trillion.

Despite its pervasiveness—or, perhaps, because of it—globalization remains deeply contentious. Supporters argue that globalization provides less-developed countries with market access and opportunity to grow their economies. Detractors, meanwhile, argue that globalization allows multinational companies to cross borders freely in pursuit of private interests, usually at the expense of domestic enterprises. But as Kofi Annan, former secretary general of the United Nations, has pointed out: “Arguing against globalization is like arguing against the law of gravity.”

The automotive industry is greatly impacted by globalization, especially since trade in manufactured goods has outpaced traditional sectors such as mining and agriculture. Exports of automotive products grew explosively from $319 billion in 1990 to $1.18 trillion in 2007. Auto parts trade, in particular, expanded over six times from $109 billion to $680 billion in almost the same period.

Institutions like World Trade Organization and International Monetary Fund have long promoted globalization. Customs unions and regional trade blocs such as the European Union, Mercosur, Association of South East Asian Nations, Gulf Cooperation Council, and East African Community also drive—or have resulted from—globalization. A number of free-trade agreements (FTA) have also been inked to formalize globalization protocols: North American FTA, ASEAN FTA, China-Thailand FTA and Japan-Philippines Economic Partnership Agreement, among others.

Despite its pervasiveness—or, perhaps, because of it—globalization remains deeply contentious

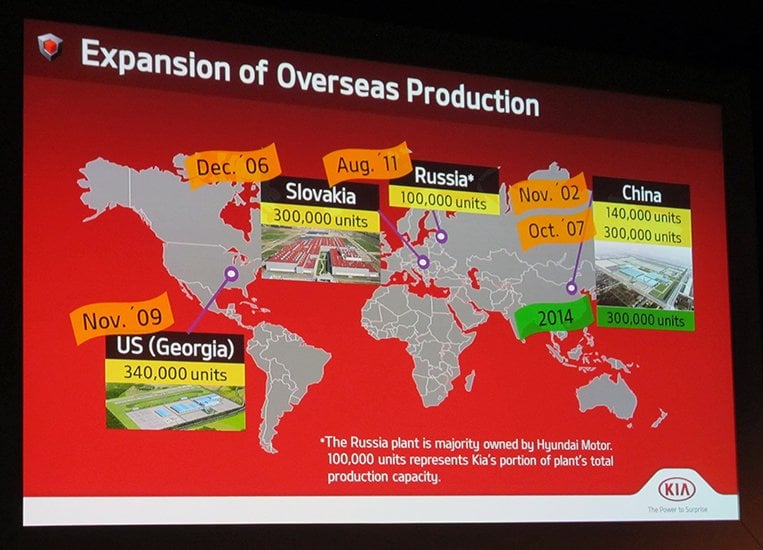

Indeed, globalization continues to reshape the business and manufacturing landscape of automobiles.

In the Americas, the USA Big Three (GM, Ford and Fiat Chrysler) have all invested heavily in car manufacturing in Mexico. They capitalize on lower production costs there to build vehicles that are shipped back to the US. Competitive cost advantage is a key fulcrum of globalization. Looking at the production split of autos among the NAFTA signatories, Mexico has seen its share grow from 17% in 2004 to 19% in 2014. At that rate, it has been projected to rise to 25% by 2020. Reportedly, 80-90% of auto production investment has flown to Mexico (or Southern USA).

Automotive production has also shifted significantly elsewhere. From 2007 to 2013, production in China grew by a stunning 149%. India expanded by 72%. In the same period, Italy declined by 49%, and France by 42%. It can be argued that these investment flows follow the movement of vehicle demand. Nonetheless, it reflects the readiness—and ease—of capital to flow to markets with rising business opportunities, a hallmark of globalization.

In ASEAN, investments by auto companies have also been on the uptrend. This resulted partly from the growth in motorization and partly because of manufacturing incentives initiated by government to promote new technologies and local industry. Sales in the region climbed from 1.9 million units in 2007 to 3.2 million in 2016. Likewise, special local manufacture programs—Thailand’s Eco Car Program, Indonesia’s Low Cost Green Car Program, Malaysia’s Energy Efficient Vehicle Program, and the Philippines’ Comprehensive Automotive Resurgence Strategy—encourage investment dollars their way. So government policy is clearly another key driver of globalization.

Globalization has trounced trade protectionism and nationalization. Developing countries are especially inclined to promote local auto manufacturing because of the significant gains it offers: jobs, taxes, technology transfer, component manufacturing. In ASEAN, for example, it used to be that strict localization and tariff regulations made building a factory in one country a given. Local production was the only way to go. But when the ASEAN Industrial Cooperation scheme and, eventually, the Common Effective Preferential Tariff came into effect, tariff barriers dropped to 5% or even 0%. This enabled a new approach that made it possible to produce vehicles (and components) in one ASEAN nation to serve the whole regional block, allowing better economies of scale and more efficient production.

These massive shifts in production greatly impact the host countries: factories close, secondary and tertiary industries wither. On another end, though, a new factory rises, support industries grow, and industry thrives. One’s loss translates to another’s gain. It is the simple and inarguable rule of economics that governs the efficient allocation of scarce resources.

For example, General Motors called it quits in India and shut down its factory of over 21 years in Halol. Because sales remained below targets, production for domestic sales ceased, affecting some 1,000 workers. At the same time, GM also reportedly pulled $1 billion in further investments. Assumably, these resources will be redirected to other markets.

Recently, Toyota closed its factory in Australia after over 50 years in operation. The government’s policy of promoting agriculture and mining over local manufacture made it challenging for carmakers to sustain production and export of vehicles. Domestic sales will now be supplied from Japan, Thailand and the US. Erstwhile export markets, on the other hand, will shift sourcing to other Toyota production bases.

Finally, in the Philippines, when Ford halted its production in 2012, it cost the country 250 jobs. Production was then moved to Thailand where the scale of Ford’s operation was several times what it was in the Philippines.

Globalization is a strong and undeniable economic force. It carries a number of unintended consequences but also benefits. For one thing, it assures auto companies that they can continue to build cars at a sustainable cost. And, in the end, the consumer wins.

Comments