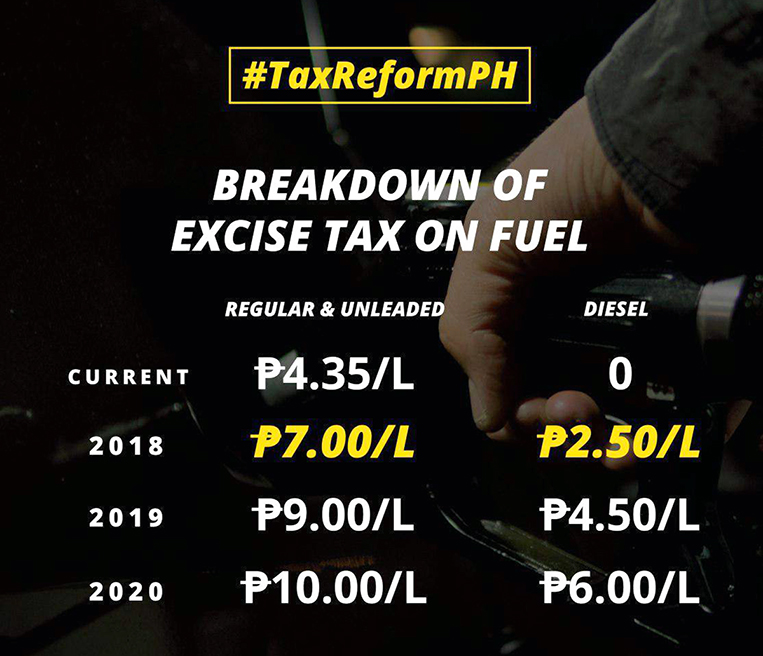

There have been concerns regarding the possible increase in prices due to the controversial Tax Reform for Acceleration and Inclusion Act, including those of fuel products. For vehicle owners like me, this directly affects our budget for fuel and lubricants. If you have been complaining about the roller-coaster pricing of fuel every week, know that this tax reform will definitely make it climb an upward slope even further every year until a peak point in the third year of implementation. For commuters, a petition from PUV drivers and operators for a fare increase is certain to come. Pair this with the pending modernization of jeepneys, and life for already disgruntled commuters could become even more challenging.

How about the basic necessities? Initially, I was also worried about these, being familiar with how logistics affects the prices of goods. Sure, logistic cost isn’t fuel alone—it also includes personnel, storage, system, toll fees and other miscellaneous stuff. But fuel substantially accounts for the overall logistic expenditure. Roughly 20% of the price of a basic consumer product can be attributed to logistics, especially fresh and unprocessed food.

But according to my helpful friend who happens to be an economic expert, the revised taxes will not significantly move prices, and at most the effect will be quite negligible. Supply and demand will still drive the prices of basic commodities. What is more worrisome as far as inflation is concerned is the liquidity of our economy: With increased economic activity and a lower income tax rate, people will get more money and thus spend more, spurring demand and driving prices up, my friend explained. Worse, there will be businesses taking advantage of the situation. They will charge more than what they’re supposed to, eventually creating an artificial surge in prices.

Logistic cost isn’t fuel alone, but fuel substantially accounts for the overall logistic expenditure

Some of my colleagues who live at the other end of the metropolis sometimes use the MRT, and they’re fond of recounting how worried they are about getting stuck in the middle of the tracks and not reaching the next station. They always swear they won’t ride the MRT again, but they still do—what choice do they have?

Similarly, Filipinos have no choice now. The government is keen on implementing the tax reform, with the expected revenue growth to be used for financing its “Build, Build, Build” program, which includes improvements on our railway system as well as mass-transport and infrastructure projects in the provinces with the hope of decongesting Metro Manila. Inevitably, prices will increase, but our income tax rates will also go down. This is beneficial, especially to middle-class and mid-management workers.

We’re just crossing our fingers that this TRAIN will bring us to the next station and not derail our progress.

Comments