One of our readers got in touch with us on Facebook about his recent experience with the Land Transportation Office, and we thought we’d better clarify the matter.

First and foremost, there’s a lot of variance between insurers and even between individual policies as to what exactly isn’t covered, what is covered, and up to where coverage exists. It’s best to read your insurance policy and ask your agent if you have any questions on coverage, especially since everyone’s vehicles, risk profiles, and other circumstances are different.

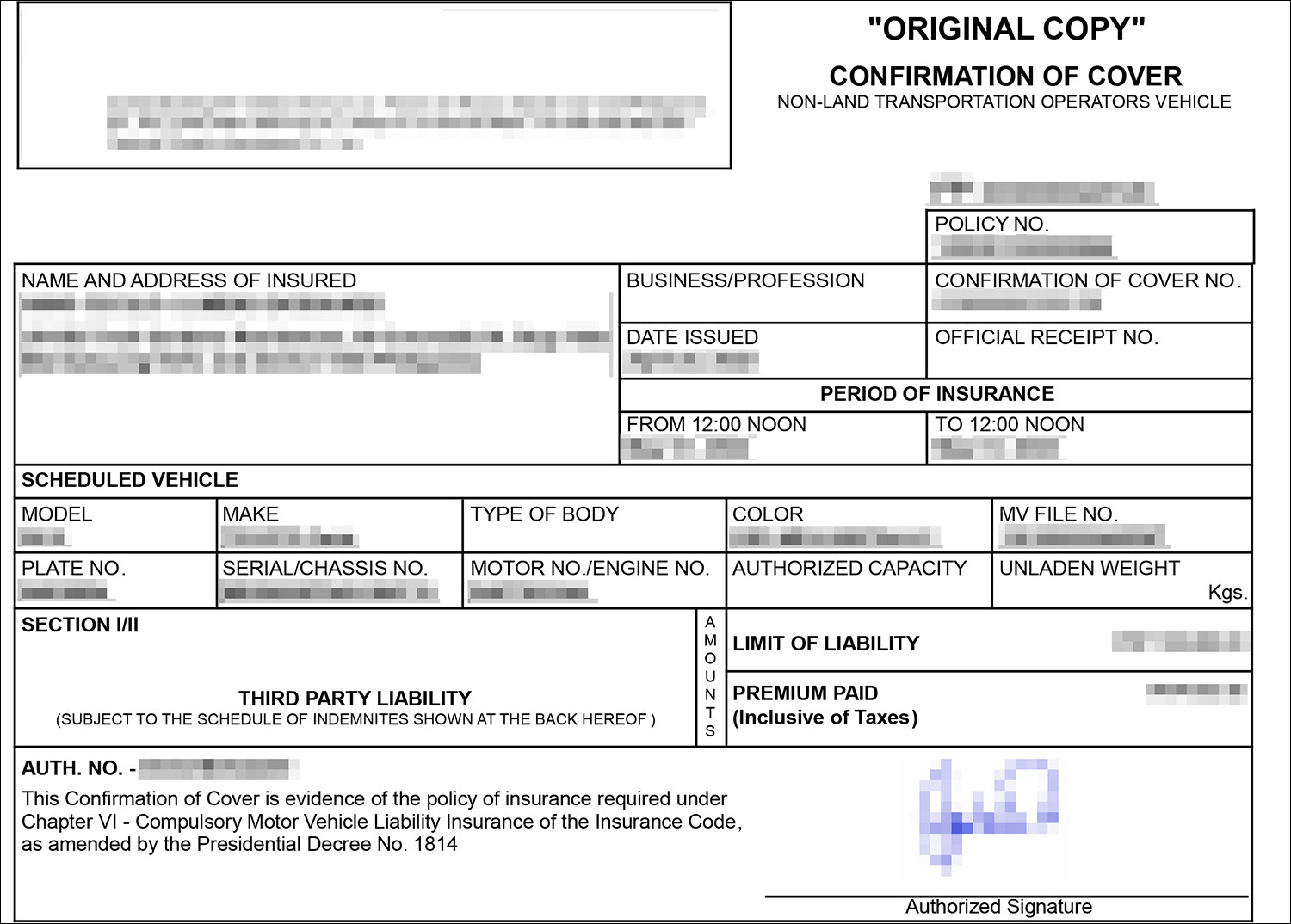

Compulsory Third Party Liability insurance (CTPL) is a requirement for renewing motor vehicle registration. This ensures that, in the event of any incident that occurs, there is sufficient insurance coverage for those that are neither the driver, their family members, nor paying passengers of the vehicle (the so-called third party, as defined in RA10607).

But what if you want to insure your own car, your family, or yourself? That’s where comprehensive insurance comes in. It typically covers damage and loss of the vehicle itself, hospitalization, disability, and death of the driver, the occupants, and others that may be involved, but this varies considerably depending on the policy purchased.

That might make you wonder why the CTPL is still required when comprehensive insurance can include third parties. Well, given that it is a requirement under the law, there are minimum coverage limits that insurers can provide for the CTPL (such as a mere P20,000 for death or bodily injuries).

Comprehensive insurance provides larger (and more reasonable) coverage for excess third-party liabilities, but this is on a voluntary basis (hence the term Voluntary Third Party Liability, or VTPL).

For example (and a cursory knock on wood that this doesn’t happen), you were to have a collision with a stranger’s vehicle. Your wife was with you onboard, along with her friend. The CTPL only covers bodily harm and death of the stranger and your wife’s friend (as she is neither a relative nor a paying passenger). It does not cover you, your wife, or either vehicle, and that’s where comprehensive insurance usually comes into play.

While insurers can issue both the CTPL and the comprehensive insurance together in one package, the CTPL remains the requirement and should be issued distinct from the comprehensive insurance. Since it’s that specific, the policy’s Confirmation of Cover (COC) should mention if it is indeed (or contains) the required CTPL cover. If you’re still unsure, you can always ask the agent who sold you the insurance.

While it’s important to stand your ground sometimes, it’s rather important to make sure that you are on the side of the truth in the first place. Besides saving face, it may also save you cash by pre-purchasing your CTPL with your insurance provider of choice before heading to LTO.

NOTE: A previous version of the article wrongly implied that the CTPL covers property damage. RA10607 only requires coverage of death or injury.

Comments